Understanding the Importance of Extended Reporting Period (ERP) Coverage

Why Avail the Extended Reporting Period (ERP)?

As an organization cancels, does not renew, or shuts down – it may face gaps in coverage from its claims-made policies. Tail coverage, also known as the Extended Reporting Period, would extend your reporting period for claims that arise from past wrongful acts. This would ensure continued protection after the end of your policy.

Why Do You Need ERP?

A claims-made policy would only cover the claims reported during the policy period. If you do not have an ERP, none of the claims from past acts will be covered once your policy expires. On the other hand, if you do have ERP, you have access to crucial protection against claims, especially if they surface years after your policy expires.

How does ERP Work?

An ERP can work under various circumstances. This includes:

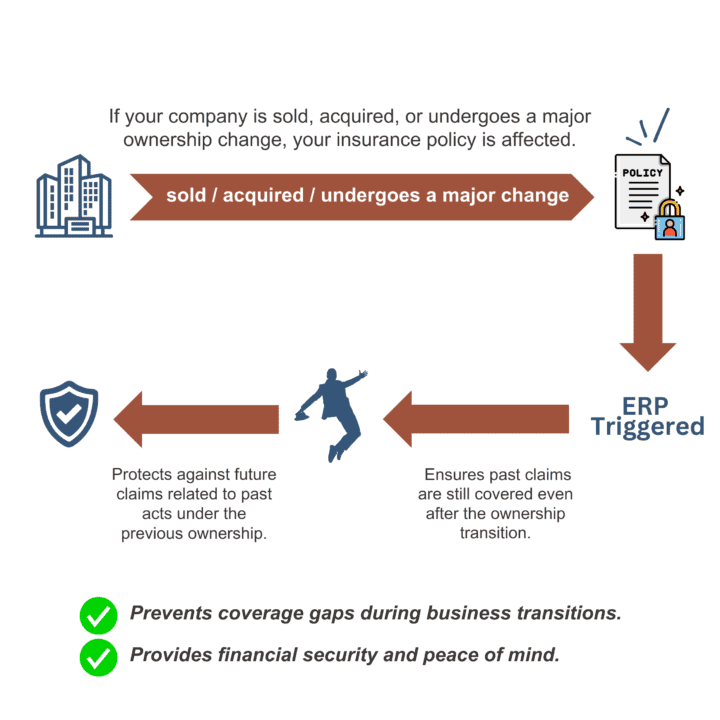

- If your company is sold, acquired, or simply faces a major ownership change, under the Change of Control provision, the policy would automatically switch to ERP coverage.

- Given that you choose to not renew your policy, or choose another provider, ERP would ensure coverage for claims against past acts.

Some Common ERP Scenarios:

- A company shut down in 2019, but has purchased ERP to cover any claims from work done between 2009-2019.

- When a company is acquired, ERP can be automatically triggered to cover any past wrongful acts.

- The insured has denied renewal, but ERP allows the organization to remain insured against future claims from previous periods.

Key Takeaways:

- ERP provides extended protection against past claims, even after your policy ends.

- ERP is optional, but extremely valuable – especially during mergers, acquisitions or shutdowns.

Remember to review your policy renewal for ERP provisions. We’re sure that by now, you know how important it is for you.