Hurricane Idalia Causes Moderate Insured Losses in Low-Population Area

Hurricane Idalia, a Category 3 storm, recently made landfall in a sparsely populated area, resulting in relatively low insured losses estimated at around $2.2 billion, according to catastrophe modeler Karen Clark & Co. The impact of location on total and insured damage has been highlighted by the storm’s landfall in a less densely populated region of the Florida Coast.

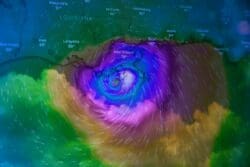

Hurricane Idalia’s Landfall and Path

Idalia made landfall at Florida’s Big Bend, near Keaton Beach, on the morning of August 30 as a powerful Category 3 hurricane with sustained winds of 125mph. This was the strongest hurricane to hit the Big Bend region since an unnamed storm in 1896. As it moved inland, the storm gradually weakened and impacted Georgia, South Carolina, and North Carolina.

Insured Loss Estimates

Karen Clark & Co. estimates that insured wind losses from Hurricane Idalia will amount to approximately $2 billion, with an additional $210 million in storm-surge losses. It’s important to note that these estimates do not include losses covered by the National Flood Insurance Program or losses related to boats and offshore properties. The calculations take into account residential, commercial, and industrial properties, as well as automobiles.

Comparison to Other Loss Estimates

The insured loss outlook provided by Karen Clark & Co. is lower than previously released estimates. Reinsurance broker BMS had estimated insured losses ranging from $3 billion to $6 billion. However, the economic losses resulting from the storm could be much higher. AccuWeather predicts total damage and economic losses for the affected states to range between $18 billion and $20 billion.

Record-Breaking Storm Surge

Karen Clark & Co. states that the storm surge caused by Hurricane Idalia is likely to be record-breaking. However, it is worth noting that the take-up rate for flood insurance in the area where Idalia struck is very low.

Hurricane Idalia, despite being a Category 3 storm, caused moderate insured losses due to its landfall in a low-population area. The estimated insured losses amount to approximately $2.2 billion, primarily from wind and storm-surge damage. However, the economic losses are expected to be much higher, with estimates ranging from $18 billion to $20 billion. The low take-up rate for flood insurance in the affected region highlights the importance of understanding and evaluating the risks associated with natural disasters.