Announcement from Horizon BCBSNJ to insurance agents: South Jersey Radiology Associates (SJRA) and Larchmont Medical Imaging (Larchmont) facilities have decided to end their agreement to participate in Horizon’s provider networks effective April 1, 2024. While we regret their decision, Horizon is ready to help your client’s covered employees connect with another in-network provider and assist […]

See more

BUYERS’ MARKET NO MORE As the digital age deepens, businesses have been benefiting from a buyers’ market in cyber insurance, courtesy of relatively low premiums and generous coverage options. However, with the increasing sophistication and frequency of cyberattacks, this trend is expected to pivot. Industry leaders are now sounding the alarm on an imminent […]

See more

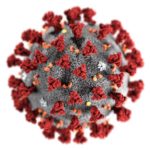

In an alarming surge of digital extortion, cyber criminals have shattered previous records by amassing over $1.1 billion in ransom payments in 2023. This figure, released by cybersecurity experts, marks an unprecedented escalation in the severity and frequency of ransomware attacks targeting businesses, governments, and individuals worldwide. Ransomware, a malicious software designed to […]

See more

The world of professional liability insurance can be complex and confusing, especially when it comes to understanding the difference between an occurrence policy and a claims-made policy. These two types of policies are the most common in the realm of professional liability insurance, and it’s critical for professionals to understand their distinctions to ensure […]

See more

The rapid surge in cyber threats has become a significant cause for concern among consumers, yet a surprisingly small percentage are opting for appropriate insurance measures for protection. According to the latest Agency Forward survey conducted by Nationwide, only 15% of American consumers currently maintain personal cyber insurance. In this age of digital interconnectedness, […]

See more

For lawyers and attorneys, the practice of law involves handling complex legal matters and providing critical advice to clients. However, even the most seasoned professionals can find themselves facing unexpected legal challenges. In such instances, professional liability insurance serves as a crucial safety net, offering protection against claims of negligence, errors, or omissions. In […]

See more

In the ever-evolving legal landscape, it’s crucial for law firms to stay ahead of the curve and embrace modern practices. By leveraging innovative tools and strategies, law firms can enhance productivity, improve client satisfaction, and streamline their operations. In this blog, we will explore four simple game-changers that can help modernize your law firm and […]

See more

As a lawyer, protecting your clients’ confidential information and data is critical. Cyber liability coverage can help to mitigate the risks associated with data breaches and cyber attacks. However, it’s important to choose the right cyber liability coverage for your practice. In this blog, we will explore the top 8 factors lawyers need to consider […]

See more

Firing an employee is never an easy task, but it’s a necessary one when it comes to maintaining a productive and positive work environment. However, terminating an employee can also open your business up to potential lawsuits if not handled properly. In this blog, we will explore some simple ways to avoid lawsuits when firing […]

See more

In today’s digital age, businesses are collecting more data than ever before. While this data can be incredibly valuable for businesses, it also presents a significant risk. Hackers are constantly looking for ways to steal sensitive information, and businesses need to take steps to protect their clients’ information. Here are some steps that businesses […]

See more

As a professional, you understand the importance of protecting yourself and your business from risk. One of the ways you can do this is by purchasing professional liability insurance, which provides coverage for claims made against you or your business for professional errors or omissions. However, it’s important to understand that adding an Additional Insured […]

See more

Should Professionals Report Claims to Their Insurance Carrier? You should always speak with your broker or agent before filing a claim. As an insurance professional, you are likely well aware of the importance of reporting claims to your carrier. However, in case you’re not sure why it’s so important, here are some reasons why […]

See more

In compliance with the Stark waiver, many practices that provide diagnostic services overlooked the Anti-Markup Payment Limitations (the AMPL”) regulation tat prevents how much health care providers can inflate prices for such services. Practices that have not complied with the AMPL may find themselves recipients of Medicare overpayments subject to repayment. The Center for Medicare […]

See more

Some good information from HealthEquity…. We have some updates to share around recent legislative changes that may impact your consumer-directed benefits. Internal Revenue Service (IRS) Releases 2023 Index Figures On October 18, 2022, the Internal Revenue Service (IRS) announced the official 2023 Healthcare Flexible Spending Account (HCFSA), Limited Purpose FSA (LPFSA), commuter, and adoption […]

See more

REGISTER NOW Join Sara Simkins for an in-depth review covering the Employer Shared Responsibility (ESR) provision, associated penalties and year-end demand for payment letters. Learn what steps should be taken promptly if you receive the notice. Topics to be covered include: The basics of the ESR provision First-time Applicable Large Employers (ALEs) Overview […]

See more

What is EPLI and Why is it Important? Employment Practices Liability Insurance (EPLI) is a form of insurance that protects a business against wrongful acts that can take place during employment such as discrimination, wrongful termination and workplace harassment, retaliation, defamation and more. The rate at which businesses, including small ones, are exposed to these […]

See more

Mending a tainted reputation isn’t an easy task, as the Boy Scouts of America (BSA) are experiencing. Following 82,000 claims received by prior BSA members, the organization has struggled to recover financially, as well as to recover their reputation. Over the years, BSA has gained a legacy surrounding sexual abuse. Most parts of a […]

See more

Throughout 2021 the employment practices liability (EPL) market saw premium and retention increases between 10-25%, with underwriters increasing prices to remain profitable. According to a 2021 market overview, primary EPL insurers were not interested in writing new EPL coverage, and their appetite was about 10-15 insurers. Because of EPL insurers hesitation to take new […]

See more

Substance use disorder and mental health advocates have been long awaiting updates to the DAACA and MHPA confidentiality provisions. Advocates were hoping for updates allowing for easier sharing of patient information between mental health and substance abuse disorder providers, in hopes to provide more efficient and satisfactory patient care. DAACA and MHPA were put […]

See more

Accusations under Illinois’ Biometric Information Privacy Act include allegations that TikTok has been using technology for facial recognition in order to pin down user ages, gender, and ethnicity. They allegedly used this information to factor into their algorithm of recommending videos to users, and prevent minors from using the app. The allegations claim that […]

See more

With the constant worry of cybersecurity breaches in today’s world; how can we safely send HIPAA compliant text messages out to our patients/clients? What is the Risk You Take in Sending Private Information Over Text? Although texting is an easy and efficient way to send information out to patients and or clients, there is […]

See more

As challenges and trends surface on TikTok, people of all ages attempt to recreate them. A recent challenge that has resurfaced, the “blackout challenge”, took the lives of two young girls. Following their tragic deaths, TikTok is being sued for wrongful death. What is the Challenge? The blackout challenge is when people essentially choke […]

See more

The Health Insurance Portability and Accountability Act (HIPAA) is a federal law in the healthcare industry that protects sensitive patient information from being disclosed without the patient’s consent. HIPAA compliance is important for patient safety as well as for healthcare workers to avoid possible lawsuits. Who Becomes a HIPAA Privacy Officer? A HIPAA Privacy […]

See more

Practice Continuation Agreement (PCA) A practice continuation agreement (PCA) is a plan set in place that authorizes another person to take on the responsibilities of an accounting firm under extreme circumstances. Circumstances that may cause the plan to go into effect are disability, ongoing illness, family emergencies and more. Having a PCA in place before […]

See more

As of recently, there have been many significant healthcare lawsuits throughout the country. Some of which include: lawsuit against the OSHA inspection in a Texas hospital, a hospital director of the West Virginia University affiliate of violating patient safety, and hospitals suing the United States Department of Health and Human Services over a […]

See more

What is First-Party Cyber Coverage? First-Party cyber coverage is liability insurance that can help small businesses protect themselves against cyberattacks. The financial impacts of cyberattacks can be significant, so it is very important to make sure that your small business is protected against the potential financial burden of cyber attacks. First-party […]

See more

In this article, it explains that workers’ compensation insurance is one of the most important insurance policies for a small business, and that most small businesses are required to have workers’ compensation insurance. Businesses regularly are losing and adding employees over time, and this can impact the specific level of coverage that the business needs. […]

See more

This is an excellent article from Fox Rothchild: https://www.foxrothschild.com/publications/covid-19-construction-contracts-and-potential-claims-under-business-interruption-civil-authority-and-other-insurance-policies-and-endorsements/ Attached is a PDF Download of this article for your convenience.

See more

The following bulletins have been issued by the New Jersey Department of Banking and Insurance and are posted on the Department’s website. Bulletin No. 20-11 Guidance Concerning Circumstances Related to the COVID-19 Pandemic (Individual Market) Bulletin No. 20-12 Guidance Concerning Circumstances Relating to the COVID-19 Pandemic (Small Employer Market) Bulletin No. 20-13 […]

See more

April 10, 2020 UnitedHealth to offer nearly $2B in accelerated payments, financial support to providers (Fierce Healthcare-April 7, 2020) The insurer said that it would accelerate claims payments to both medical and behavioral health care providers across its fully insured commercial, Medicare Advantage (MA) and Medicaid plans. It will also make $125 million in […]

See more

Governor Murphy Signs Executive Order Extending Insurance Premium Grace Periods 04/9/2020 TRENTON — Governor Phil Murphy today signed Executive Order No. 123, extending grace periods during which certain insurance companies, including health insurers, life insurers, and property and casualty insurers, will not be able to cancel policies for nonpayment of premiums.“We know the stringent measures […]

See more

Thursday, April 9, 2020 New Jersey Governor Murphy has signed an Executive Order extending the grace period for residents unable to pay their insurance premiums because of a loss of income or other negative impact as a result of the COVID-19 emergency. The Governor’s Executive Order requires: A minimum 60-day grace period for health […]

See more

Helpful information from our local Chamber of Commerce: Hello GVCC Member – Attached is a presentation provided today by the NJEDA with information about their initial COVID-19 Economic Response Package. The grant program is available to select small businesses. It will be open for applications this FRIDAY, APRIL 3 beginning at 9am and will […]

See more

The Senate passed the Federal Coronavirus Aid, Relief, and Economic Security Act (CARES/H.R. 748) on Wednesday, March 25, 2020. COVID-19 UPDATE Coronavirus Aid Relief and Economic Security CARES Act PASSED – Highlights For Your Medical Practice Today, March 27, the House has approved the bill. This is the third major bill by Congress in response […]

See more

Please read this announcement from the SBA regarding their disaster loan program for new applications: U.S. Small Business Administration To submit an application: Email: Email your completed document(s) as attachments to: disasterloans@sba.gov Any information you send to SBA via email is sent via an unsecured email link. Due to the nature of […]

See more

NEW EXECUTIVE ORDER No. 109 EO-109 Governor Phil Murphy today announced a new state website for reporting personal protective equipment (PPE). In accordance with Executive Order No. 109, any business, non-hospital health care facility, or institution of higher learning in possession of PPE, ventilators, respirators, or anesthesia machines must submit that information to the State […]

See more

EO-107 EO-108

See more

This information is provided as a service based on what we have been given at this time. Please contact your agent and/or insurance carrier for more up-to-date and additional information. I hope this helps. I know it is very challenging for all healthcare practices and facilities right now. God bless all our First Responders as […]

See more

COBRA During the State of the Emergency, are employees or employers penalized for issuing COBRA notices at a later time if they are unsure of the nature of the layoff (permanent or temporary)? As it stands today, the current law as written applies. Therefore, COBRA rules apply as they would in any layoff. Should legislation […]

See more

Please find attached most recent Health Insurance Carrier Benefit update Spreadsheet. CarrierBenefitsCoronavirusChart 2020March25

See more

We received word from Horizon that we are free to share the following updates about furlough. A formal brief from Horizon is expected later today. ______________________________________________________________________________________ We received a few responses as it relates to COVID-19 Horizon administrative inquiries- below please find some initial guidance on some of your questions below: Q Can employer groups […]

See more

When it comes to mistakes done on some work it can be counted as either an error or an omission. Both of them have the same result, work is not completed to a satisfactory standard and both can be central to a claim. However, the difference between the two can make a significant difference in […]

See more

Let me begin by stating the Professional Liability Insurance Group does not provide legal advice and strongly advises that every business seek appropriate legal and professional advice for all business needs. One of the biggest concerns when you’re terminating an employee contract is whether there will be repercussions from the event. There are numerous issues […]

See more

Do you know of any scenarios which might arise in a liability claim from an employee? You could probably name a couple but there are most likely some you don’t know. Here are five examples of employment practice liability cases we’ve created for your benefit. We’ve also added in a line to describe how a […]

See more

What insurance do you need if you manage a legal practice? While law firms tend to be careful about what they can and can’t say – that doesn’t mean they can’t make mistakes which can be costly to the business should a claim be made against them. Of course, how much insurance your law firm […]

See more

If you want to run a successful business there are many lessons you can learn from the most profitable law firms. It doesn’t matter if you are going to manage a law firm or another business, the way they operate can provide lessons to any industry. Here are three things that you can learn from […]

See more

Your business has a limited liability when it comes to claims. This is determined by the shares or guarantees it owns. In contrast, the personal liability of a director / officer of the company is unlimited. If a claim is made against them, their personal assets are at risk. Also, it is a common misconception […]

See more

Most people don’t think of their office as an inherently dangerous working environment. After all, it isn’t like there are cars, heavy objects moving above heads or other external dangers that can threaten life and limb. However, the office environment does have some serious dangers. The top workplace injuries; back and neck pain, vision […]

See more

The world is becoming ever more digital. We are spending more time on social media, and this is leading to court cases as people disagree over its use. In recent years there have been numerous landmark social media lawsuits that have had a profound impact on how social media can be used within your business. […]

See moreToday’s modern world is becoming ever more digital, and with it, threats from hackers and cyber criminals are becoming more of a risk for all professions, including lawyers. To protect your business should the worse happen, you should seriously consider cyber liability insurance. Is it suitable for everyone? What are the seven factors you need […]

See more

According to a report released this week by the Treasury Inspector General for Tax Administration (TIGTA), almost 65,000 tax-exempt organizations owe close to $875 million in back taxes to the federal government. Underlying this gross negligence in tax abuse is the fact that the IRS has seen a reduction in key enforcement personnel: a slashing […]

See more